All Categories

Featured

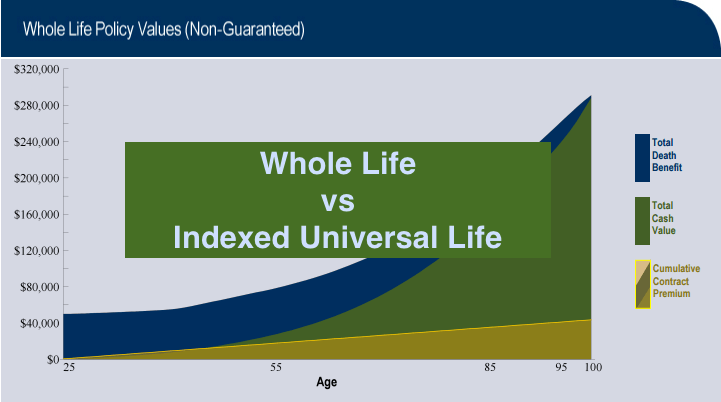

If you're mosting likely to utilize a small-cap index like the Russell 2000, you may want to stop briefly and consider why a great index fund business, like Vanguard, doesn't have any type of funds that follow it. The reason is since it's a lousy index. Not to state that altering your entire policy from one index to an additional is rarely what I would call "rebalancing - universal life insurance death benefit options." Money value life insurance coverage isn't an appealing property class.

I have not also attended to the straw guy right here yet, and that is the truth that it is reasonably uncommon that you actually have to pay either taxes or significant commissions to rebalance anyway. I never ever have. The majority of intelligent investors rebalance as much as feasible in their tax-protected accounts. If that isn't fairly adequate, very early accumulators can rebalance simply making use of new contributions.

Universal Life Insurance With Living Benefits

Decumulators can do it by withdrawing from asset classes that have succeeded. And naturally, nobody ought to be getting packed shared funds, ever before. Well, I hope blog posts like these aid you to translucent the sales tactics frequently utilized by "economic specialists." It's actually regrettable that IULs do not function.

Latest Posts

Equity Indexed Life

Best Guaranteed Universal Life Insurance Companies

Nationwide Yourlife Indexed Ul Accumulator